Buy power tools and accessories with Klarna Finance.

Don’t compromise your next purchase, when you can spread the cost with transparent financing.

FLEXIBLE TERMS

APPLY ONLINE

INSTANT DECISION

0% INTEREST OPTIONS

Three ways to spread the cost of your new tools:

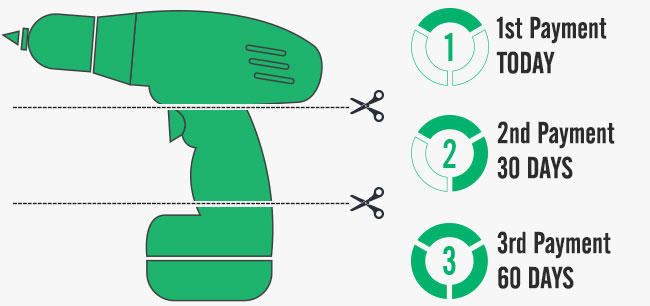

PAY IN 3 MONTHS

Spread your payment over 3 months with no interest. This option is available on orders from £99 – £1200 inc. vat.

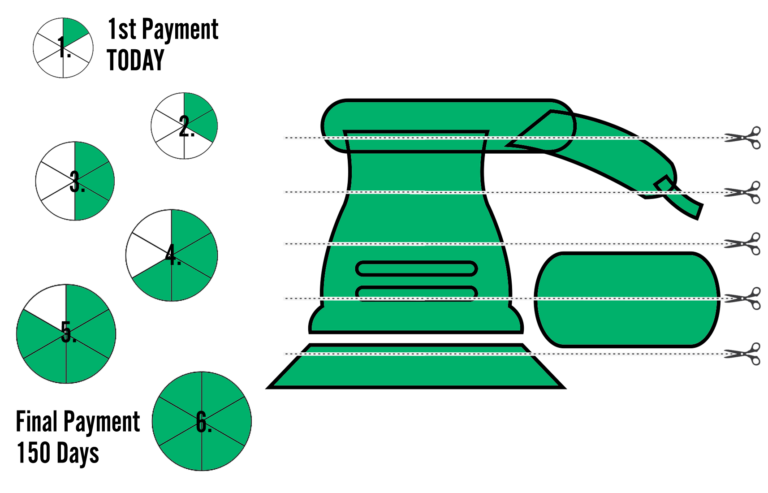

6 MONTHS INTEREST FREE

Spread your payment over 6 months interest free. This option is available on orders from £250 to £8000 inc. vat.

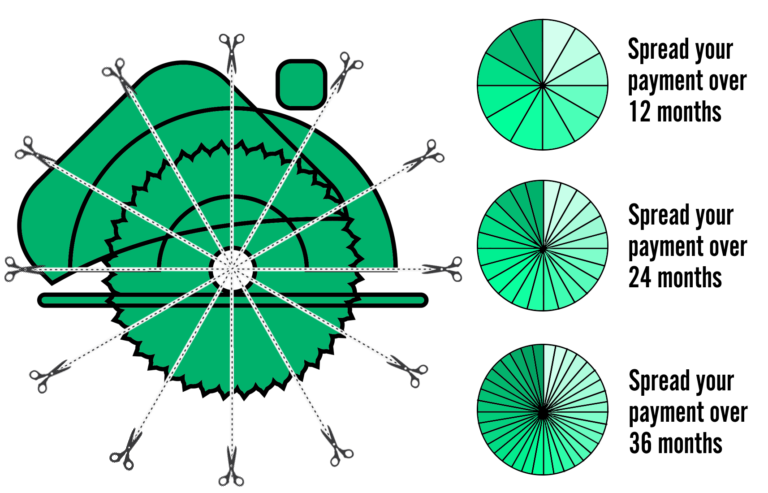

UP TO 36 MONTHS FINANCE

Spread your payment over up to 3 years at 21.9% APR. This option is available on orders from £250 to £8000 inc. vat.

HOW DOES IT WORK?

1. Spend £99 or more

Klarna payment plans are available on any orders between £99 and £8000 inc. vat. The basket can be made up of as many items as you like.

2. Select Klarna

Select ‘Pay in Installments’ at checkout, then ‘Place Order’. A new window will present you with your finance options and repayment illustrations. Choose whichever suits your needs.

3. Select your finance offer

Fill out the short form to apply for financing and receive an instant answer. Then enter your payment details with either a Direct Debit or Credit/Debit Card depending on finance option.

4. Manage your payments on the Klarna app

Download the Klarna App to manage your payments and view all transactions. You will also see how much you have left to repay and stay on top of budgeting.

SPREAD PAYMENT OVER 3 MONTHS

AVAILABLE ON ORDERS OVER £99 INC. VAT

Spend between £99 and £1200 inc. vat and your first instalment will be collected once your order is confirmed. Instalments 2 and 3 will be taken from your debit or credit card 30 then 60 days later – making it easy and affordable for you to buy that new drill you have your eye on.

6 MONTHS INTEREST FREE

AVAILABLE ON ORDERS OVER £250 INC. VAT

Spend between £250 and £8,000 inc. vat and your first instalment will be collected once your order is confirmed. The following instalments will be taken from your debit or credit card at 30 day intervals meaning your purchase will be with you immediately, but you can spread your payments to keep your finances manageable.

UP TO 36 MONTHS FINANCE

AVAILABLE ON ORDERS OVER £250 INC. VAT

Spend between £250 and £8,000 inc. vat and your first instalment will be collected once your order is confirmed. With affordable interest rates of 14.9% APR, you can start using and earning with the best quality kit, but choose to pay over 12, 24 or 36 months.

HOW MUCH COULD MY MONTHLY REPAYMENTS BE?

Below we give you an illustration of what your monthly payments could be depending on the size of your purchase. Where a deposit is required, a 10% deposit has been used as an example. Deposit amounts are generated dynamically by Klarna, and may vary according to your circumstance. The final payment may vary by a small amount to adjust for any rounding and ensure the balance is cleared at the end of the term. A full repayment schedule will be provided to you before accepting the agreement.

- Based on a £300 purchase

Plan Deposit (10%) Cost per Month Total Payable 3 Months n/a £100 £300 6 Months n/a £50 £300 12 Months* n/a £27.55 £330.00 24 Months* n/a £15.02 £359.80 36 Months* n/a £10.89 £391.21 All indicated payments including VAT

* 21.9% APR - Based on an £800 purchase

Plan Deposit (10%) Cost per Month Total Payable 3 Months n/a £266.66 £800 6 Months n/a £133.34 £800 12 Months* n/a £74.10 £887.56 24 Months* n/a £40.71 £974.94 36 Months* n/a £29.72 £1,067.45 All indicated payments including VAT

* 21.9% APR - Based on a £1200 purchase

Plan Deposit (10%) Cost per Month Total Payable 3 Months n/a n/a n/a 6 Months £120 £180 £1,200 12 Months* £120 £100.03 £1,318.21 24 Months* £120 £54.96 £1,436.16 36 Months* £120 £40.12 £1,561.09 All indicated payments including VAT

* 21.9% APR - Based on a £5000 purchase

Plan Deposit (10%) Cost per Month Total Payable 3 Months n/a n/a n/a 6 Months £500 £750 £5,000 12 Months* £500 £416.79 £5,492.57 24 Months* £500 £228.96 £5,984.22 36 Months* £500 £167.17 £6,504.53 All indicated payments including VAT

* 21.9% APR

FREQUENTLY ASKED QUESTIONS

- Who are Klarna?

Klarna are a worldwide payment provider who take end-to-end responsibility for your payment. Klarna are now one of Europe’s largest banks and provide payment solutions to more than 200,000 online stores. Over 90 million consumers worldwide trust Klarna to securely handle their payments.

- How can I improve my chances of being accepted for Klarna products?

You must be at least 18 years old. It is important to provide your full name and personal details at the checkout, which will include your email address and billing address (the address where your utility bills and electoral roll is registered). After starting your Klarna application you will be asked your date of birth, mobile number, and questions relating to your financial circumstance. Your mobile number is only used in case Klarna need to reach you. All orders are assessed on an individual basis according to certain criteria. Protrade has no influence over which Klarna products are offered to you.

- Will I need to pay anything straight away?

In some cases, you may need to pay some of the balance as a deposit at the time of purchase. If this is the case, you will be prompted to pay a deposit as part of the Financing application.

- Can I set up automatic payments?

During the application process you will be asked to set up a Direct Debit Mandate from your bank. Klarna will take your monthly payments from your bank account automatically via this Direct Debit Mandate so you won’t need to do anything. It is important to ensure that you have enough funds in your account to cover the repayments on your due date each month.

- What if I am late or miss a payment?

Your monthly payment must reach Klarna by the payment due date. If youfail to do so, Klarna may report information to credit reference agencies about the payments you make, and about any payments that you fail to make on time. Late or missing repayments may have serious consequences for you. Your credit rating may be affected which will make it more difficult or more expensive for you to obtain credit in the future. If at any time you miss consecutive payments, Klarna may serve you a default notice requiring you to repay what you owe. If you fail to do so, Klarna may terminate your Financing agreement and assign the debt to a debt collection agency acting on behalf of Klarna. Klarna may also sell the debt to a debt collection agency.

If you are having trouble making repayments, please get in touch with Klarna customer service via the support section of the Klarna app or via Klarna’s customer support page.

- I purchased my tools on Klarna Financing plan and I would like to return them.

Please contact our support team at sales@protrade.co.uk to enquire about returns. Once your return has been processed your Klarna Financing plan will be adjusted accordingly.

Protrade Ltd is authorised and regulated by the Financial Conduct Authority (FCA FRN 944654) and acts as a credit intermediary and not a lender, offering credit products provided exclusively by Klarna Financial Services UK Limited. Please note that the following products are not regulated by the FCA: Pay in 30 days and Pay in 3 instalments. Finance is only available to permanent UK residents aged 18+, subject to status, terms and conditions apply. www.klarna.com/uk/terms-and-conditions. In the event that you have a complaint regarding the credit broking service we provide, then please let us know and we will seek to resolve your complaint promptly. If you are not satisfied with our response you may wish to take your complaint to the Financial Ombudsman Service. You can contact them as follows: Write to them at Exchange Tower, London, E14 9SR, Telephone: 0800 023 4567, or Email: complaint.info@financial-ombudsman.org.uk . Their website is: www.financial-ombudsman.org.uk.